If you’re scratching your head over what a Max-Funded IUL is, you’re not alone. It sounds fancy, but it’s actually pretty cool once you get the hang of it. A Max-Funded IUL, or Max-Funded Indexed Universal Life Insurance, is like a two-for-one deal: it’s life insurance that protects your family if something happens to you, and it’s also a way to grow your money over time. Plus, it comes with some neat tax tricks. Let’s break it down nice and slow so you can see why people are talking about it.

Defining Maximum Funding in IUL Policies

So, what’s the deal with a Max-Funded IUL? Imagine you’ve got a regular life insurance policy—you pay just enough to keep it going, and it pays out a death benefit if you pass away. Simple, right? Now, a Max-Funded IUL takes it up a notch. Instead of paying the bare minimum, you stuff extra cash into the policy—way more than you need for the insurance part. That extra money builds up inside something called “cash value,” which grows over time.

It’s still life insurance, but it’s also like a savings account with benefits. The “max-funded” part means you’re putting in the most the IRS allows without turning it into a taxable investment. Pretty smart, huh? It’s a way to protect your loved ones while growing a nest egg for yourself—all in one package.

How a Max-Funded IUL Operates

Alright, let’s roll up our sleeves and see how a Max-Funded IUL actually works. It’s not like a regular savings account or a stock you buy and forget. It’s got moving parts, but don’t worry—I’ll explain it like we’re chatting over coffee. This policy is flexible, tied to the stock market in a safe way, and designed to make your money grow without too much risk.

How Cash Value Grows in an IUL

First things first: when you pay into a Max-Funded IUL, your money splits into two buckets. One bucket keeps the insurance running—that’s the death benefit part. The other bucket is your cash value, which is like your personal stash inside the policy. This cash value is where the growth happens, and it can grow in two different ways depending on how you set it up.

Steady Growth Accounts

Let’s start with the steady growth account. Picture this as the calm, reliable option—kind of like a savings account at the bank, but inside your Max-Funded IUL. You earn a fixed interest rate, say 2% or 3% a year, no matter what’s going on with the stock market. It’s not going to make you rich overnight, but it’s a safe place to park some of your money. Think of it as the foundation of your policy—steady and predictable. If you’re someone who likes knowing exactly what you’re getting, this part of a Max-Funded IUL feels reassuring.

Market-Linked Accounts

Now, here’s where it gets fun: the market-linked account. This part of your Max-Funded IUL is tied to a stock market index, like the S&P 500, which tracks 500 big companies in the U.S. When the market goes up, your cash value grows too—sometimes by a decent chunk! For example, if the S&P 500 jumps 10% in a year, you might see your cash value grow by 7% or 8%.

But here’s the best part: if the market crashes, you don’t lose anything. There’s a “floor”—usually 0%—that protects your money. So, you get a taste of the market’s gains without the stomach-churning drops. It’s like riding a roller coaster with a safety harness.

MUST READ: Decoding Your Credit Card Statement: A Deep Dive into the Minimum Due

Understanding Participation Rates in IULs

Okay, you might be thinking, “Do I get all the market’s gains?” Not exactly—and that’s where participation rates come in. Let’s break it down.

How Do Participation Rates Function?

The participation rate is like a dial that decides how much of the market’s growth you get to keep in your Max-Funded IUL. Say the S&P 500 goes up 10% in a year, and your participation rate is 80%. You’d earn 8% on your market-linked account.

It’s not the full 10%, but it’s still a solid boost! The insurance company sets this rate to balance things out—they’ve got to cover their costs, after all. In a Max-Funded IUL, they often tweak it to make sure your extra cash gets a good shot at growing.

Why Are They Important?

Why should you care about participation rates? Because they’re a big piece of the puzzle for how fast your cash value piles up. A higher rate means more growth when the market’s hot—like getting a bigger slice of pie.

A lower rate might slow things down, but it’s still better than nothing. With a Max-Funded IUL, the goal is to maximize your cash, so these rates are set up to help you make the most of your overfunding. It’s all about finding that sweet spot between growth and safety.

Lowering Costs with Max-Funded IUL

Let’s talk money—specifically, the fees. Every insurance policy has costs, like administration fees or commissions for the agent who sells it to you. In a regular policy, those fees can eat up a big chunk of your payment. But with a Max-Funded IUL, you’re putting in way more cash than the minimum.

Over time, those fees become a smaller percentage of your total pot. Imagine it like this: if you pay $100 and $10 goes to fees, that’s 10%. But if you pay $1,000 and the fee’s still $10, it’s only 1%. That’s the beauty of a Max-Funded IUL—more of your money stays in the game, growing for you.

MUST READ: Top Stock Market Movies and Web Series

Safe Cash Value Growth in Max-Funded IUL

Safety is a huge selling point for a Max-Funded IUL. You don’t want to lose your hard-earned cash, right? That 0% floor I mentioned earlier means your cash value won’t shrink, even if the stock market takes a nosedive. But there’s another cool feature that keeps things secure.

The Yearly Reset Advantage in IULs

Here’s how it works: every year, your gains from the market-linked account get locked in. Say your Max-Funded IUL earns 6% one year—awesome! That gain is yours, sealed tight. If the market flops the next year, you don’t lose that 6%. It’s like saving your progress in a video game—you don’t slide back to zero. This “yearly reset” makes a Max-Funded IUL feel like a smart, steady way to grow money without sweating every market headline.

Starting Your IUL and Growing Cash

Ready to get going? Starting a Max-Funded IUL is easier than you might think. You team up with an insurance company, figure out how much you want to put in (up to the IRS max), and decide how to split it between steady and market-linked accounts. The trick is to fund it early and often—think of it like planting a tree. The sooner you start, the bigger it grows. Over the years, that cash value can turn into a hefty sum, all thanks to the way a Max-Funded IUL is built.

MUST READ: What Is Personal Finance, Meaning, Importance & Tips

Exploring Max-Funded IUL Mechanics

Let’s zoom in a bit more on how a Max-Funded IUL ticks. It’s not just about throwing money in and hoping—it’s got a system that’s worth understanding.

A Sample Growth Scenario for Max-Funded IUL

Picture this: you put $10,000 a year into your Max-Funded IUL. In year one, the market-linked account earns 7%—your cash value jumps to $10,700. Year two, the market’s flat, so you stay at $10,700—no losses! Year three, it earns 5%, bumping you to $11,235. See the pattern? It’s not a straight line up, but it’s steady growth without the dips.

After 20 or 30 years, that could turn into tens or even hundreds of thousands, depending on how much you put in and how the market behaves. That’s the power of a Max-Funded IUL—slow and steady wins the race.

Can Max-Funded IUL Outperform the S&P 500?

Here’s a big question: can a Max-Funded IUL beat the stock market? Well, sometimes yes, sometimes no. The S&P 500 might rocket up 15% in a great year, but your Max-Funded IUL might cap out at 10%. Why? There’s a ceiling on gains to balance out that 0% floor. In a bad year, though, the S&P could drop 20%, while your Max-Funded IUL sits pretty at 0%. Over time, it might not match the market’s peaks, but it avoids the valleys. It’s about consistency, not chasing the highest highs.

MUST READ: What Are the 4 Pillars of Personal Finance?

Pros and Cons of Max-Funded IUL

Is a Max-Funded IUL all it’s cracked up to be? Let’s weigh the good stuff against the not-so-good to see what’s what.

Advantages of Choosing Max-Funded IUL

Why pick a Max-Funded IUL? For starters, your cash value grows tax-deferred—meaning you don’t pay taxes on the gains each year like you would with a regular investment. You can also borrow from it tax-free if you play by the rules. It’s flexible too—you can adjust how much you pay or what the death benefit is as life changes. Then there’s the safety: that 0% floor keeps your money safe from market crashes. And don’t forget the death benefit—if you pass away, your family gets a payout. It’s a combo of protection and opportunity.

Weighing the Benefits and Downsides

Let’s balance it out. The upsides of a Max-Funded IUL are awesome: growth potential, tax perks, and no market losses. But there are downsides too. It’s not super simple—there are fees, caps, and rules to learn. Upfront costs can sting, and it takes time to see big results. If you’re patient and okay with a little complexity, a Max-Funded IUL can be a winner. If you want quick cash or hate paperwork, it might not be your vibe.

Common Criticisms of IUL Investments

Some folks aren’t fans of IULs, including the Max-Funded IUL. They say it’s too complicated—too many terms like “participation rates” and “caps.” Fees can be high early on, and those caps mean you miss out on the market’s best years. All fair points! But here’s the flip side: a Max-Funded IUL cuts fees over time with overfunding, and the tax savings can outweigh the caps if you stick with it. It’s not perfect, but it’s got its strengths.

Comparing Max-Funded IUL to Alternatives

How does a Max-Funded IUL stack up against other ways to handle your money? Let’s compare it to the usual suspects.

Max-Funded IUL vs. Other Financial Options

Take stocks: they can soar, but they can crash too—think 2008. A Max-Funded IUL grows slower but doesn’t tank. Bonds are safe but boring—low returns over time. Real estate? You might make a killing, but you’re fixing leaky roofs too. A Max-Funded IUL sits in the middle: decent growth, no big losses, and less hassle. It’s not the flashiest, but it’s steady.

How IUL Differs from Whole Life Insurance

Whole life insurance is like a reliable old car—fixed interest, no surprises, just chugs along. A Max-Funded IUL is more like a hybrid: it’s got market-linked growth potential and lets you tweak payments or coverage. Whole life is simpler but grows slower; a Max-Funded IUL takes more effort but can pay off bigger.

Is IUL a Smarter Choice Than a 401(k)?

Tough call! A Funded IUL has no contribution limits (unlike a 401(k)’s cap) and offers tax-free loans later. But a 401(k) might get you a company match—free money!—and it’s simpler to manage. If you’re maxing out your 401(k) already, a Funded IUL could be a great sidekick. It’s about what fits your life.

Real-Life Uses for Max-Funded IUL

A Max-Funded IUL isn’t just numbers on paper—it’s a tool you can use in real ways. Let’s explore how.

Using IUL for Retirement Goals

Dreaming of retirement? A Funded IUL grows cash you can tap later—tax-free if you borrow against it. It’s not instant money, but it’s a backup plan that keeps building while you work. Think of it as a quiet partner for your future self.

Max-Funded IUL as a Retirement Tool

Imagine you’re 65, and your Max-Funded IUL has $200,000 in cash value. You borrow $20,000 a year to cover bills—no taxes, no fuss. The policy keeps growing, and you’ve got steady income. It’s not a get-rich-quick thing—it’s a long-term helper.

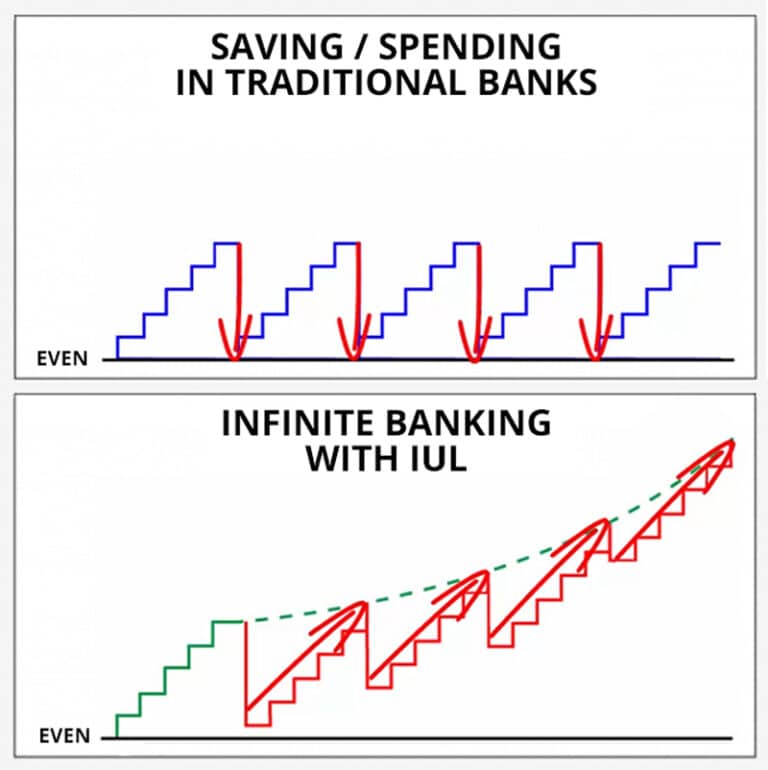

Max-Funded IUL in Personal Banking Strategies

Ever heard of “infinite banking”? With a Funded IUL, you overfund it, then borrow against the cash for big stuff—like a car or a down payment. You pay yourself back with interest, keeping the profits in your pocket. It’s like being your own bank, and a Funded IUL makes it possible.

Extra Protection with Chronic Illness Benefits

Some Funded IUL policies throw in a bonus: if you get really sick—like a chronic illness—you can tap the death benefit early. It’s not something you hope to use, but it’s there, adding an extra layer of “what if” protection.

Is Max-Funded IUL Worth It?

Let’s get down to it—is a Max-Funded IUL a good idea for you? Here’s the scoop.

Who Might Benefit from Max-Funded IUL?

This is perfect for people with extra cash to invest—like high earners who’ve maxed out other options. If you love tax savings, want a death benefit, and don’t mind waiting for results, a Funded IUL could be your match. Younger folks get the most bang for their buck since time is on their side.

How Safe is Max-Funded IUL?

Super safe! That 0% floor means your cash value stays put in a crash, and insurance companies are regulated to keep your money secure. A Funded IUL is like a fortress for your savings.

What Happens During a Market Downturn?

If the market drops 20%, your Funded IUL earns 0%—no losses, just a pause. When things bounce back, you’re ready to grow again. It’s built to weather the storm.

Steps to Begin with Max-Funded IUL

Thinking of jumping in? Here’s how to start a Funded IUL.

What’s the Price Tag for Max-Funded IUL?

Costs depend on you—age, health, how much you fund. It might be $5,000 to $50,000 a year. Fees hit early (5-10% of premiums), but overfunding a Funded IUL makes them less painful over time. Shop around for the best deal!

What’s a Bare-Minimum IUL?

This is the skinny version: low payments, tiny cash growth, big death benefit. A Funded IUL goes the other way, piling in cash for savings.

How Does a Bare-Minimum IUL Function?

It’s all about the insurance—keeps the death benefit alive with little extra. A Funded IUL flips that script for max growth.

Common Questions Answered (FAQs)

Got some burning questions about a Max-Funded IUL? You’re not alone! People often wonder about the nitty-gritty details, and I’m here to clear things up with answers that make sense. Let’s tackle these one by one, so you feel confident about what a Max-Funded IUL can do for you.

Can I Take Money Out of My Max-Funded IUL?

Absolutely, you can! One of the coolest things about a Max-Funded IUL is that it’s not just locked away forever. There are two main ways to get at your cash value: borrowing or withdrawing. Borrowing is the popular choice—you can take out a loan against your Max-Funded IUL’s cash value, often tax-free, as long as the policy stays active.

Imagine you’ve built up $50,000 in cash value after a few years. You could borrow $10,000 to cover a big expense—like fixing your car or taking a trip—and pay it back over time at a low interest rate set by the insurance company. The policy keeps growing while you repay, so it’s like borrowing from yourself without derailing your plan.

Withdrawals are an option too, but they might trigger taxes if you take out more than you’ve paid in premiums. Most folks stick with loans to keep the tax perks intact. It’s flexible, which makes a Funded IUL feel like a financial safety net you can actually use.

What Defines a Max-Funded IUL?

Good question! A Max-Funded IUL is all about pushing an Indexed Universal Life (IUL) insurance policy to its full potential. Normally, with life insurance, you pay just enough to cover the death benefit—the payout your family gets if you pass away.

But with a Max- Funded IUL, you go big: you pour in extra money, way more than the minimum, up to the limit the IRS allows before it’s considered a taxable investment. That extra cash builds up in the policy’s cash value, growing over time through steady or market-linked accounts.

So, it’s still insurance—your loved ones get a payout if you’re gone—but it’s also a savings tool designed to pile up cash for you to use later. Think of it as a turbo-charged version of regular IUL, blending protection with a serious growth strategy.

Is Max-Funded IUL a Secure Option?

You bet it is! Safety is one of the biggest reasons people love a Max-Funded IUL. Here’s why: your cash value is protected by a 0% floor, meaning even if the stock market crashes hard, your money doesn’t shrink.

Let’s say the S&P 500 drops 25% in a year—scary, right? With a Max- Funded IUL, your cash value stays put at 0% growth for that year, no losses. Plus, insurance companies are heavily regulated—they’ve got to keep enough money on hand to back your policy, so your Funded IUL isn’t going anywhere.

It’s not like gambling on stocks where you could lose it all. This combo of market protection and insurer stability makes it a rock-solid choice if you’re nervous about risk but still want growth.

What Happens to Max-Funded IUL in a Market Crash?

This one trips people up a lot, so let’s dig in. If the stock market tanks—like a 20% or 30% drop—what happens to your Max-Funded IUL? Nothing bad, that’s what! Thanks to that 0% floor we talked about, your cash value doesn’t go down. For example, imagine your Max-Funded IUL has $100,000 in cash value, and the market crashes. While regular investors might see their portfolios shrink, your cash value stays at $100,000—no bleeding money there.

The market-linked part just pauses at 0% growth for that year. When the market recovers—and it always does historically—you’re back in the game, earning gains again. It’s like your Max-Funded IUL takes a breather during the storm and picks up where it left off when the sun comes out. That’s peace of mind you can’t get with straight-up stocks.

How Expensive is Max-Funded IUL?

Let’s talk dollars and cents. The cost of a Funded IUL varies a ton because it depends on you—your age, health, and how much you want to put in. If you’re 30 and healthy, you might pay $5,000 a year to start. If you’re 50 or have some health issues, it could be $20,000 or more. Then there are fees—upfront costs like 5-10% of your premium for things like administration or the agent’s commission.

So, if you pay $10,000, $500-$1,000 might go to fees at first. But here’s the good news: because a Funded IUL is overfunded, those fees shrink as a percentage over time. After a few years, more of your money stays in the policy, growing instead of paying costs. It’s not cheap to start, but it’s an investment that can pay off big if you stick with it. Shopping around for quotes is key—different insurers offer different deals.

What’s Meant by Minimum-Funded IUL?

A minimum-funded IUL is the flip side of a Max-Funded IUL. It’s when you pay just enough to keep the insurance part alive—no extra cash for growth. Think of it like running a car on fumes: it works, but it’s not going far. With a minimum-funded IUL, your premiums cover the death benefit and basic costs, leaving little or nothing for the cash value to build up.

It’s cheaper month-to-month, but you miss out on the savings power that makes a Funded IUL special. People might choose this if they only care about the insurance and don’t want the investment angle. It’s lean and mean, but it’s not the star of the show here—that’s the max-funded version.

How Does a Minimum-Funded IUL Operate?

So how does a minimum-funded IUL actually work? It’s pretty straightforward. You pay a smaller premium—say, $2,000 a year instead of $10,000—and almost all of it goes to keeping the death benefit active. There’s barely any leftover to grow in the cash value, so it’s not building you a nest egg.

The insurance company still offers steady or market-linked options, but with so little cash going in, you won’t see much action there. It’s like watering a plant with a teaspoon—it’ll survive, but it won’t thrive.

A Max-Funded IUL, on the other hand, pours in the water, letting the cash value bloom over time. Minimum funding is all about coverage, not growth—totally different vibe.

Should You Choose Max-Funded IUL? (Wrapping Up)

So, what’s the final word on a Max-Funded IUL? It’s a powerhouse if you want growth, safety, and tax perks. It’s not for everyone—takes cash and patience—but it’s a gem for the right person. Talk to a financial pro to see if it fits. What do you think—could a Max-Funded IUL be your next step?

Riyo is a Digital Marketing expert with specialization in SEO and Market Analysis. He has hands-on experience in keyword research, on-page & off-page SEO, and data-driven marketing strategies. Riyo helps businesses boost their online visibility and grow through smart digital tactics.